florida estate tax filing requirements

However an extension of an additional six months is generally. Generally the estate tax return is due nine months after the date of death.

At least 18 years old Mentally and physically capable of performing an executors duties and A Florida resident.

. Estates of Decedents who died on or before December 31 2004 For estates of decedents who died on or before December 31 2004 and that are required to file a federal. Tax-exempt organizations that have unrelated trade or business income for federal income tax purposes are subject to Florida corporate income tax and must file either the Florida Corporate. If you are unable to file Form 706 by the due date you may receive an.

PDF 220KB Fillable PDF 220KB DR-1FA. ACH-Credit Payment Method Requirements Florida eServices. Application for Consolidated Sales and Use Tax Filing Number.

If the estate generates more than 600 in annual gross income you are required to file Form 1041 US. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. Income Tax Return for Estates and Trusts.

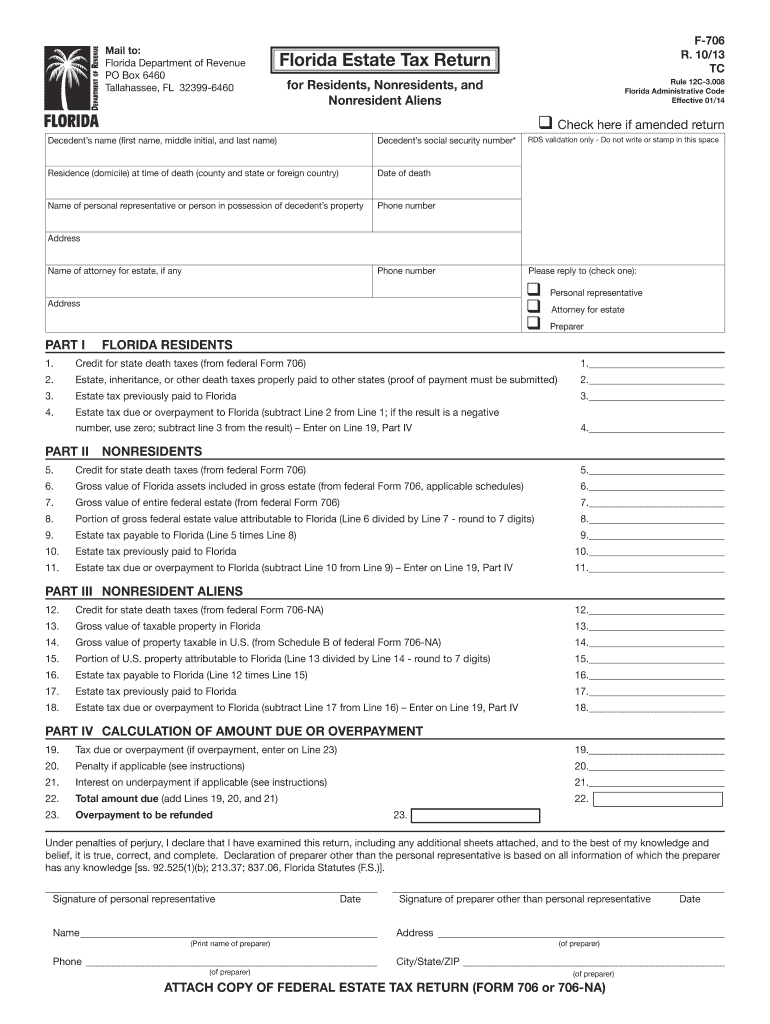

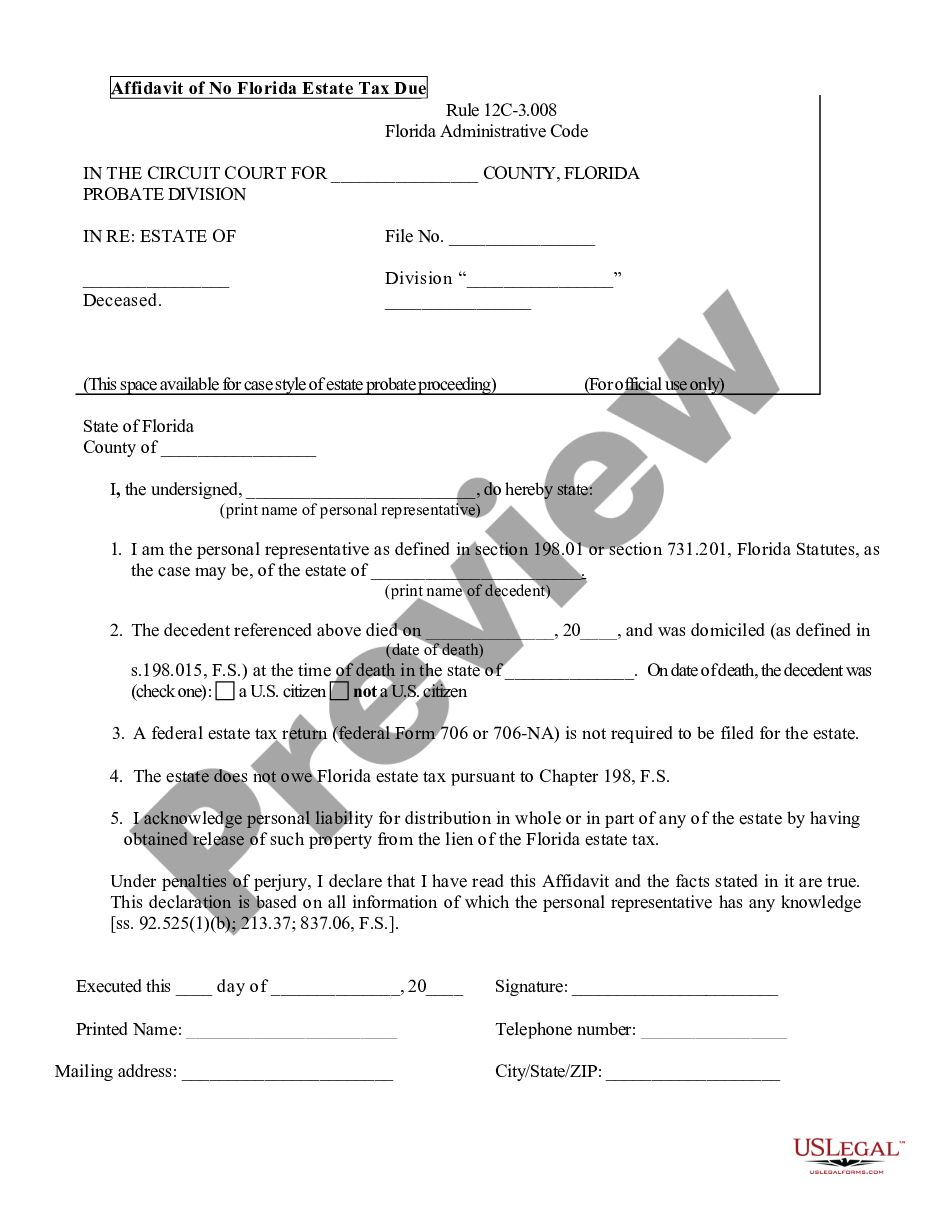

The requirement to file a Florida estate tax return is found in FS. In all cases where estate tax is due Form 706 must be filed within nine months after the decedents death. If the estate is required to file a federal estate tax return use Form DR-313 Affidavit of No Florida Estate Tax Due When Federal Return is Required.

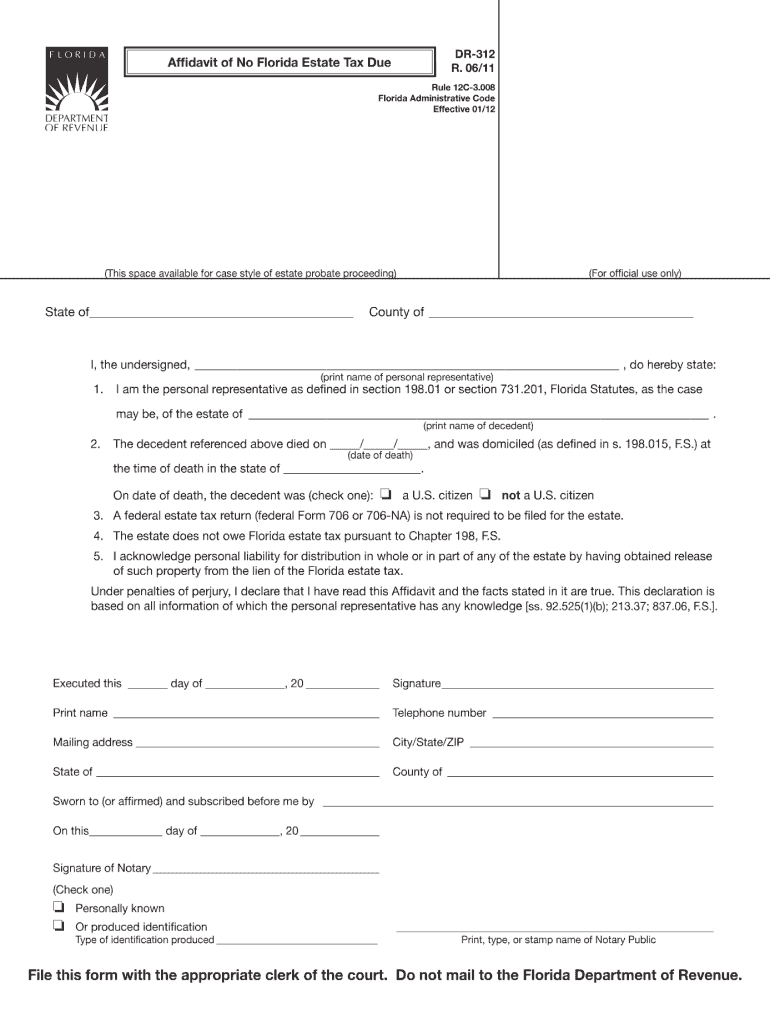

An estate may also need to pay. Additionally counties are able to levy local taxes on top of the state. When estate tax is not due because there is no federal estate tax filing requirement you should use Florida Form DR-312 Affidavit of No Florida Estate Tax Due to remove the Florida estate.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Along with payment and Florida Form F-706.

You must file Form 706 to report estate andor GST tax within 9 months after the date of the decedents death. All foreign surplus lines insurers are required to file quarterly policy information to FSLSO for policy transactions written during the quarter no later than 90 days after the quarter ends. Floridas general state sales tax rate is 6 with the following exceptions.

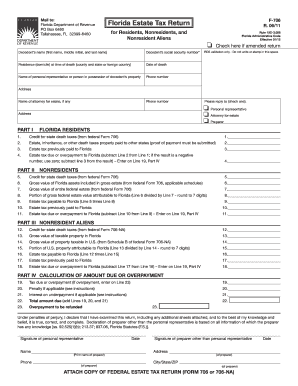

We last updated the Florida Estate Tax Return for Residents Nonresidents and. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine. Property was located in other states the Florida estate tax due is adjusted to allow for the amount of any estate taxes properly paid to other states.

Form F-706 is used to file Floridas estate tax that is based on the estate death taxes allowed by the federal. Any individual can become an executor of the estate if they are. The statute provides that a personal representative file a Florida estate tax return with the.

Dr 312 2011 Form Fill Out Sign Online Dochub

Dr219 Fill Online Printable Fillable Blank Pdffiller

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Notice Of Federal Estate Tax Return Due P 3 0950 Pdf Fpdf Doc Docx

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Form Dr 312 Affidavit Of No Florida Estate Tax Due R 06 11

Florida Estate Tax Return F 706 Fillable Online Form Fill Out And Sign Printable Pdf Template Signnow

Affidavit Of No Florida Estate Tax Due

Florida Resources Helpful Links

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

What Tax Returns Must Be Filed By A Florida Probate Estate

Florida Estate Tax Everything You Need To Know Smartasset

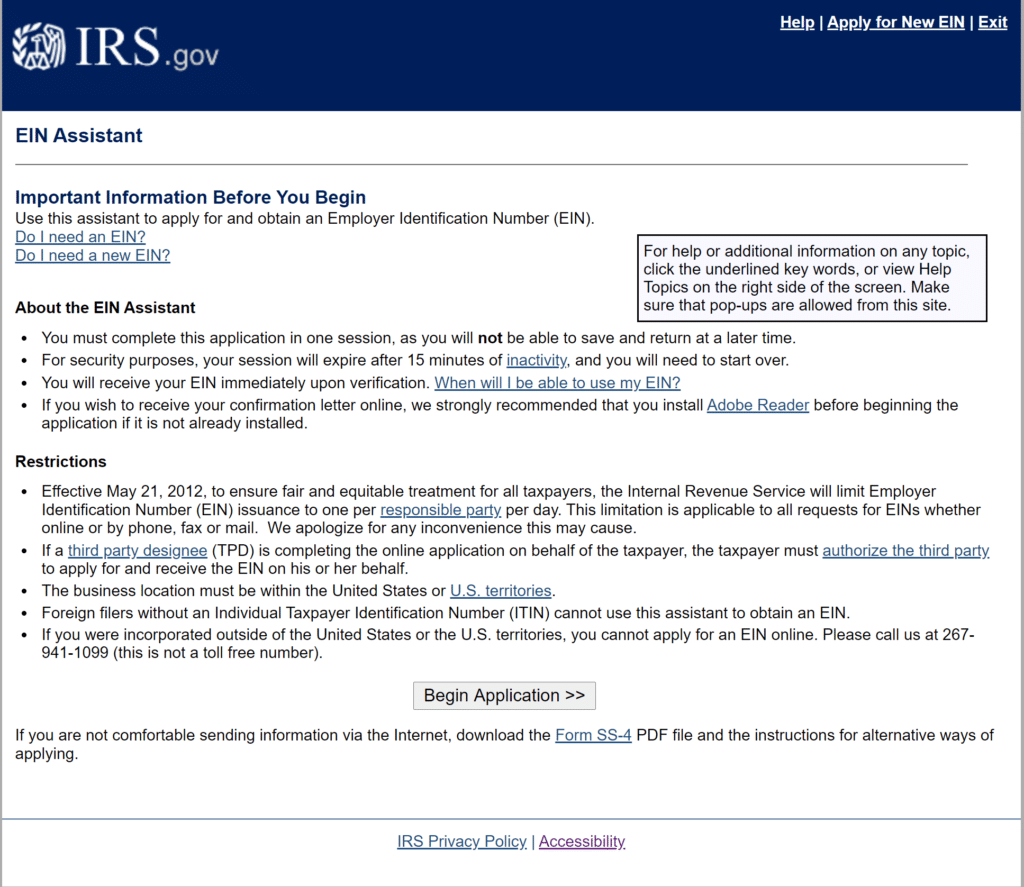

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Florida Fl Sales Tax And Individual Income Tax Information